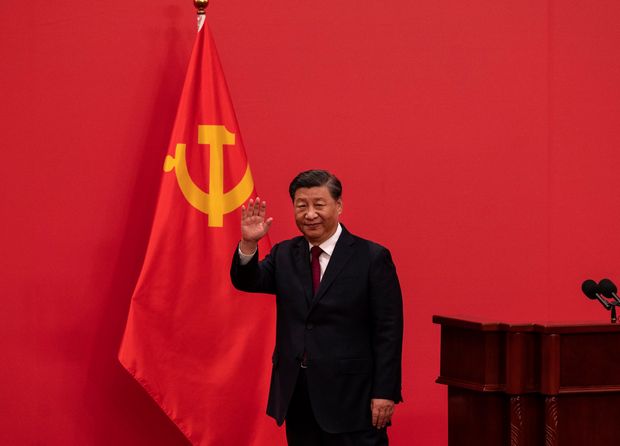

Chinese President Xi Jinping is reportedly planning to visit Saudi Arabia in the second week of December 2020

Chinese President Xi Jinping is reportedly planning to visit Saudi Arabia in the second week of December 2020

The report that Chinese President Xi Jinping is planning his first overseas trip after the Party Congress and it may be to Saudi Arabia drips with enormous symbolism. According to the Wall Street Journal, the visit is likely to take place early December and hectic preparations are under way.

The daily cited people familiar with the preparations that the Chinese leader’s “welcome is more likely to resemble” the 2017 visit by Donald Trump in its pomp and pageantry.

Predictably, the focal point will be the future trajectory of Chinese-Saudi oil “alliance” — rather, the making of an oil alliance comparable to the Russian-Saudi framework of OPEC Plus. That said, there is a great deal more to the forthcoming visit by Xi in geopolitics in the dramatically shifting alignments in the West Asian region and indeed its impact on the world order can be far-reaching.

The point is, both China and Saudi Arabia are major regional powers and any matrix involving them bilaterally will be highly consequential to international politics. The Wall Street Journal said “Beijing and Riyadh seek to deepen ties and advance a vision of a multipolar world where the US no longer dominates the global order.”

No doubt, the war in Ukraine provides an immediate backdrop. It is going to be extremely difficult for the United States to extricate itself in a near term from the war without suffering a huge loss of face tarnishing its credibility as a superpower, undermining its transatlantic leadership and even risking the future of the western alliance system as such.

Both China and Saudi Arabia will have drawn the conclusion that the “bipartisan consensus” over the war in Ukraine may not survive the fierce tribal war among the American political elite that is certain to break out very soon once the midterm elections today get over. If the Republicans gain control over the House of Representatives, they will proceed to initiate proceedings for the impeachment of President Biden.

A Guardian survey of expert opinion on Sunday was entitled These are conditions ripe for political violence: how close is the US to civil war? At its core, therefore, both China and Saudi Arabia see the US retrenchment gathering momentum in the West Asian region.

One major item of discussion during Xi’s visit to Saudi Arabia will be the latter’s “Look East” foreign-policy strategy that anticipated the US retrenchment at least by the middle of the last decade. Xi’s visit to Saudi Arabia in 2016 was a landmark event.

No doubt, Beijing has been closely watching the deterioration of US-Saudi relations since then. And it cannot be lost on Beijing that lately, Saudis have been plotting energy cooperation with China amid Crown Prince Mohammed bin Salman’s tensions with Biden.

The surest signal was the virtual meeting on October 21 between Prince Abdulaziz bin Salman bin Abdulaziz, Saudi Minister of Energy and Zhang Jianhua, China’s National Energy Administrator, a senior politician (who was a member of the 19th Central Discipline Commission of the Chinese Communist Party.) The meeting took place amidst a deep crisis in the US-Saudi relations with the US elite threatening to impose sanctions against Riyadh.

Unsurprisingly, one of the key issues discussed between the Chinese and Saudi ministers was the oil market. According to the Saudi statement, the ministers “confirmed their willingness to work together to support the stability of the international oil market” and stressed the need for “long-term and reliable oil supply to stabilise global market that endures various uncertainties due to complex and changeable international situations.” Isn’t this more or less what the OPEC Plus (Russian-Saudi oil alliance) keeps saying?

Meanwhile, the two ministers also discussed cooperation and joint investments in countries that China sees as part of its strategic Belt and Road vision and stated their intention to continue to implement an agreement about peaceful uses of nuclear energy (which Washington has opposed.)

Without doubt, the meeting of the ministers was a clear rebuke aimed at Washington, designed to remind the Biden administration that Saudi Arabia has other important energy relationships and that Saudi oil policy does not come from Washington. Most important, the calculus here is that Riyadh is seeking a balance between Beijing and Washington. Biden’s vacuous talk about a “battle between autocracy and democracy” would bother Saudi Arabia, but China has no ideological agenda.

Notably, the Saudi and Chinese ministers agreed to deepen cooperation in the energy supply chain through establishing a “regional hub” for Chinese manufacturers in the kingdom to take advantage of Saudi Arabia’s access to three continents.

The bottom line is that Saudi political and business elites increasingly perceive China as a superpower and expect a global engagement that is transactional, similar to how both China and Russia generally engage in the world. The Saudis are convinced that their “comprehensive strategic partnership” (2016) with China would enhance the kingdom’s growing geopolitical importance amid Russia’s war in Ukraine, and that it underscores that Riyadh has more choices now and will further seek balance.

Saudi Arabia has increasingly close ties with Russia, too. With one leg inside the SCO tent (having gained observer status), it is now seeking BRICS membership. These are complementary moves but BRICS format is also working on an alternate currency system, which attracts Riyadh.

Coincidence or not, Algeria and Iran, two other leading oil producing countries which keep close ties with Russia, have also sought BRICS membership for the same reason. The very fact that Saudi Arabia is joining them and is willing to bypass Western institutions and reduce the risk of interaction with them, and is instead exploring parallel ways of conducting financial, economic, and trade relations without relying on US or EU-controlled instruments does convey a big message to the international system.

The paradox is, the Saudi drive to strengthen strategic autonomy will remain fragile so long as the petrodollar ties it down to the western banking system. Therefore, Saudi Arabia has a big decision to make in regard of the continued relevance of its 1971 commitment enshrining the American dollar as the “world currency” (replacing gold) and its resolve to use only dollar for trading in oil — all of which has enabled successive US administrations through the past half century to print paper currency as they pleased, live it up by laundering the money — and eventually to weaponise dollar as its most potent instrument to impose American hegemony globally.

While reporting on Xi’s forthcoming visit to Saudi Arabia, The Wall Street Journal added that the “strategic recalibration of Saudi foreign policy is bigger than the recent blowup with the Biden administration over oil production… More recently, their (China-Saudi) courtship has intensified with discussions on selling a stake in Saudi Aramco, including yuan-denominated futures contracts in Aramco’s pricing model, and possibly pricing some Saudi oil sales to China in yuan.”

Traditionally, things used to move at a glacial pace indicative of Saudi policy shifts. But Crown Prince Salman is in a hurry to reset the Saudi compass and can take difficult decisions, as the creation of OPEC Plus in alliance with Russia testifies. Therefore, the likelihood of Saudi Arabia changing course to do part of its pricing in oil sales in yuan currency is stronger than ever today.

If things indeed move in such a direction, to be sure, a tectonic shift may be taking place — a major geo-strategic recalibration — and Xi’s visit to Saudi Arabia gets elevated as an event of historic importance.