A closed business in Santa Monica, California. (AFP)

A closed business in Santa Monica, California. (AFP)

The world economic news through last week must have sent shockwaves across North and South Block where India’s ministries of finance, defence and external affairs — and the Prime Minister’s Office — are located. The post-pandemic world order is knocking on the doors.

On Friday, the European Union released the preliminary estimates of the Eurozone economies’ performance in the second quarter of 2020. The 19-member bloc’s GDP contracted by 12.1%. This followed Germany’s announcement Thursday of its largest drop in GDP (10.1%) since it began keeping quarterly records half a century ago.

Germany is Europe’s powerhouse and alone generates almost a quarter of the EU’s GDP. This is how a German commentator at Deutsche Welle surveys the gathering storms:

“Neither the stock market crash nor the oil price shock could achieve what a tiny virus has done. The fruits of 10 years of growth were wiped out within weeks.

“The German economy collapsed in March but the Federal Statistics Office has said that the full force of the crisis is only now being reflected in the numbers. A 10 percent decline in the second quarter. There has never been anything like it.

“Everything has suffered — exports, imports, services, investment. It is only thanks to massive investment by the state that unemployment hasn’t gone through the roof. Around 7 million Germans are currently on so-called ‘short-time work’ — they work less and the state pays part of their wages.

“Economic advisors are divided. Some say German economy is already on a recovery course, others are bracing for a tsunami of bankruptcies.”

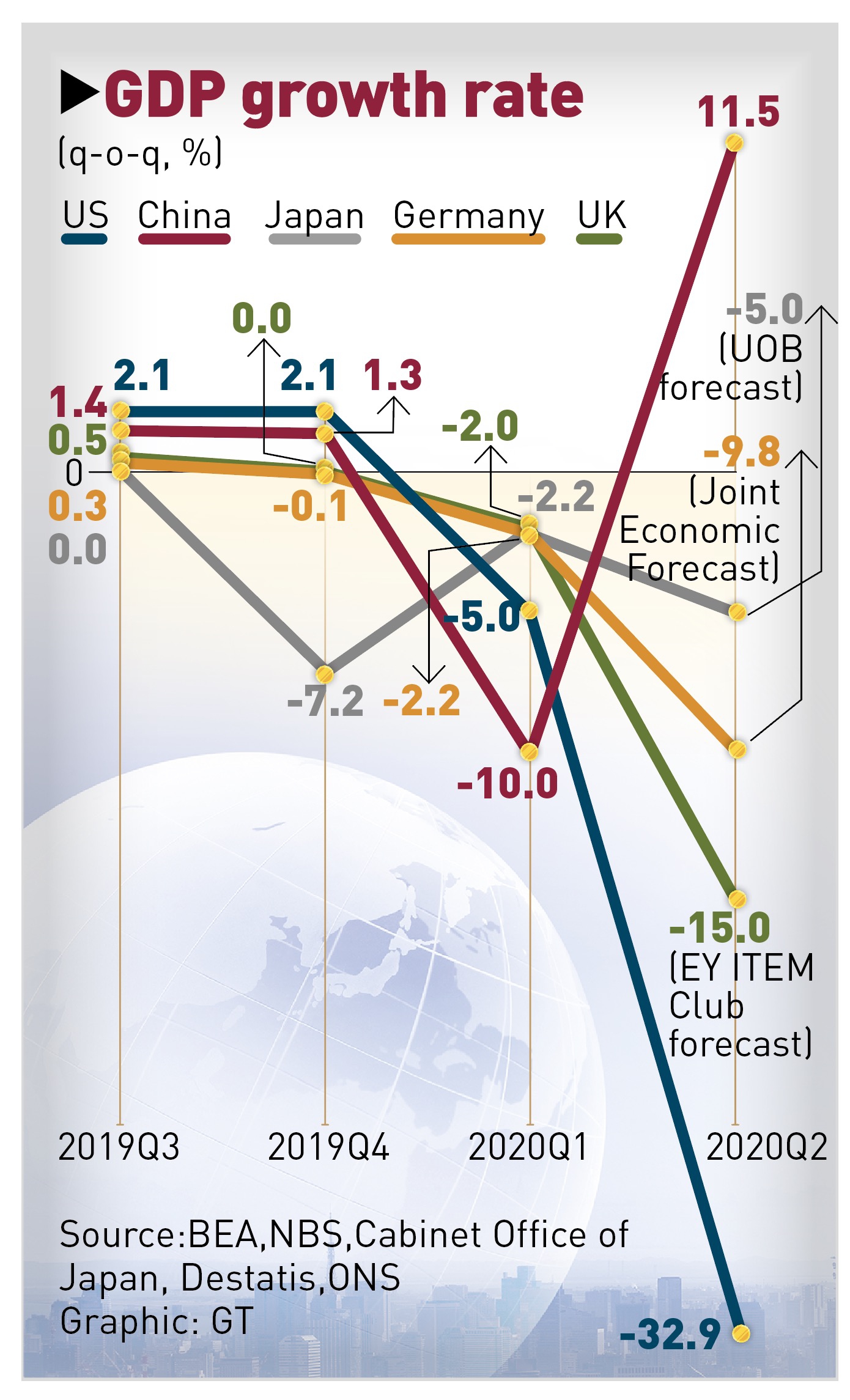

The impression was that the US has fared marginally better than Germany with a 10 percent drop. But US Commerce Department announced Thursday that the country’s GDP fell 32.9 percent in the second quarter at an annual pace, official scorecard of American economy. This marks the worst quarterly fall since US Bureau of Economic Analysis started keeping quarterly records in 1947.

The surge in coronavirus cases in recent weeks in about half of US states, especially large ones such as Texas, Florida and California, has dealt a blow to a fragile economic recovery. On Wednesday, the US surpassed 150,000 recorded COVID-19 deaths. This has devastating effect on the services sector — services — travel, tourism, medical care, eating out and so on. Spending on services nosedived at a 43.5% annual pace and consumer spending on the whole declined. Companies cut back on production as sales slumped and exports tumbled. The US exports dwindled by 64% in the second quarter, topping a 53% drop in imports.

There is unprecedented chaos. President Trump is at fault. Instead of bracing for the pandemic in the early part of the year, he resorted to blame game to cover up mismanagement. Two, he went horribly wrong in assuming that it was possible to restart the economy without controlling the virus. With an eye on the November election, he threw his political capital into restarting the economy and has ended up with one of the worst-performing economies in the western world.

Even as the epidemic gradually rebounds, there will not be much improvement in the US’ economic performance. Just forget all those dreams about a V-shaped recovery in the US GDP in the third quarter (before the November election). The strong likelihood is that as long as the US remains hostage to the virus, it won’t have real economic recovery.

Again, Japan, world’s third-largest economy, is expected to contract by an annualised 21.7 percent in the second quarter, which will be its worst quarter since World War II, according to Nikkei Asian Review. Among the major economies, China is the first to record a GDP growth in the second quarter at 3.2 percent year-on-year, following a record decline of 6.8 percent in the first quarter. In another stark comparison, China’s second quarter GDP grew by 11.5 percent from the first quarter.

The bottom line is that the US is still far away from even beginning to recover from the pandemic, while the other major economies are moving ahead in their recovery trajectories despite lingering risks and challenges from the virus. The US Federal Reserve said in a statement Wednesday, “The path of the economy will depend significantly on the course of the virus.” On Wednesday alone, the US saw more than 63,000 new infection cases, bringing total cases to over 4.5 million.

The record decline in the second quarter and the extraordinarily pessimistic outlook for the third quarter and beyond for the US economy threatens to damage Trump’s reelection bid. The skyrocketing unemployment and expected business closures have a snowballing effect, given a confluence of social issues such as racial discrimination and the unrest over the police treatment of African Americans.

The biggest lesson for Indian decision makers is what the US Fed Chair Jerome Powell said — the economic outlook depends significantly on the course of the virus. Most economists and long-term investors agree here. The future looks dim for countries like Australia, India, Spain, and Brazil where infections are on the rise.

Simply put, there is no magic wand. India cannot afford to ignore the economic reality of the virus. A recent survey by Reuters among economists predicted that it would take two or more years for India’s GDP to reach pre-COVID-19 levels.

Moving on, Trump may step up attacks on China to deflect attention away from his failed domestic and foreign policies. China’s success in handling the virus and its quick catch-up to the US in total GDP has become an eyesore for Americans. India should be extremely wary of getting entangled in the US-China tensions.

Then, there are bigger issues, too. The US economic slump will also severely drag the world economy down. The Fed pledged endless stimulus, but the US economy, growth engine for the global economy, now risks being the biggest drag, sending the dollar to a two-year low. Significantly, China, amongst others, seems reluctant to buying over-issued US Treasuries.

It means that the US is unable to transfer its debts to others. According to official data, holdings of US Treasuries by international investors fell from $7.07 trillion in February to $6.86 trillion in May. In effect, the US may have to take responsibility for its own massive debt.

A Chinese commentary disclosed that one of Trump’s grouses against Beijing is that the latter refused to listen to his entreaties to buy more more US Treasuries. At any rate, the dollar index has fallen sharply from a high of 103 points in March to below 94 points on Thursday. The dollar’s global dominance will be seriously threatened if the index drops to 80 points. A criticality is arising by the yearend. India should expect American pressure to force it to buy more US debt.

Meanwhile, we should anticipate that the global economy may never be the same again due to the pandemic, which holds consequences from trade and public health to geopolitics. Given China’s economic strength, the Trump administration’s attempts to form an international alliance against that country has been a non-starter.

India is sailing in the same boat as Australia or Japan (or even the UK) whose interests lie in maintaining strong economic and trade relations with China. It is injudicious — even illogical — for India to spurn China’s outstretched hand for mutually beneficial economic cooperation as the main template of its relationship. Some middle level American functionary in Washington may compliment the government for ‘standing up to China’. But the pandemic has not only undermined the the US’ ability to be more aggressive against China but also to compensate for the losses that third countries such as India will suffer if they follow the Trump administration’s footfalls to decouple from China.

Today’s papers have reported that output of Indian industry’s eight core sectors has shrunk by 15% on a year-on-year in the second quarter; the pandemic is raging with 40,000 new confirmed cases a day for several consecutive days; the total number of fatalities exceeds 35,000; India is now the third most infected country in the world.

In this backdrop, shutting the door on job creation and quality Chinese products at competitive price makes no sense. India lags behind in global industrial chains, relies heavily on Chinese suppliers for production and consumption, and is in desperate need of foreign investment. Cutting economic ties with China can only be self-defeating.