Oil price war in the time of Covid-19

Oil price war in the time of Covid-19

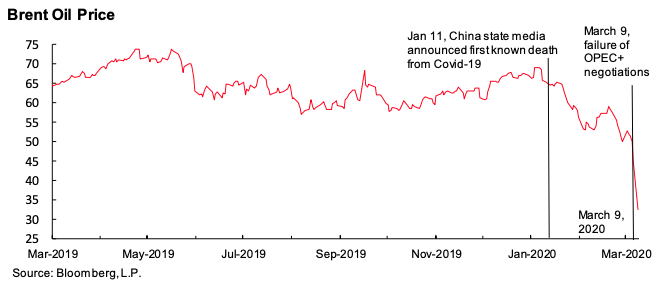

On Monday, the US President Donald Trump literally bit the bullet by telephoning Russian President Vladimir Putin to discuss the state of the energy markets, which are at a crisis point not seen in history. As of last weekend, global oil prices collapsed by over 50 percent and are the lowest seen in almost twenty years.

A defining moment has come. Starting April 1, OPEC+ countries (OPEC plus Russia) are at liberty to pump as much oil as they please. The increased oil volumes are sure to flood the oil market. Saudi Arabia has talked of offering 12.3 million barrels per day to the market.

The combination of a massive supply overhang and a significant demand shock at the same time has created an unprecedented situation in the oil market history. It threatens to have a multiplier effect on the deep recession in the world economy due to the coronavirus and the consequent lockdowns in large swathes of China and the industrial world.

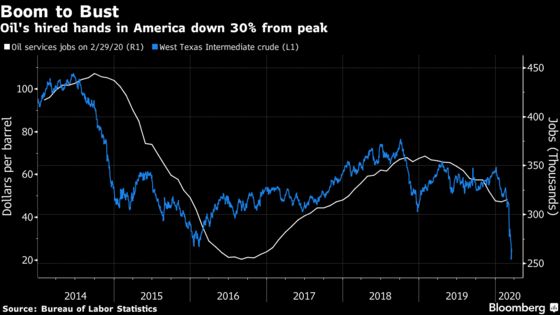

For the US, the oil market bust could mean that over half of its shale industry, which has been charioting the country’s newfound oil superpower status, may go bankrupt. Breakeven price for US shale industry ranges from $40-50 per barrel — and prices have plummeted to around $20.

A similar crisis had arisen in 2014-2016 period but shale industry survived through a combination of pushing costs lower and retrenching — and bouncing back with higher profits once the crisis was over. However, this time around, shale drillers were already facing substantial hurdles with cash flow problems and maturing debt and the dramatic fall in income simply drives them bankrupt. Again, whereas the problem earlier was one of fall in oil prices, today it is also combining with the biggest demand slump in the history of oil.

The US shale sector is getting completely killed and tens of billions of dollars in equity could get wiped out. 13 US senators wrote to the Saudi Crown Prince Mohamed bin Salman earlier this month urging halt to efforts to boost production and lower prices. They threatened to take action against Saudi Arabia if the “economic warfare” continued.

Sen. Ted Cruz from Texas told CNBC on Monday: “The Saudis are hoping to drive out of business American producers, and in particular shale producers, largely in the Permian Basin in Texas and in North Dakota. That behaviour is wrong, and I think it is taking advantage of a country that is a friend… If they don’t change their course, their relationship with the United States is going to change very fundamentally.”

However, the Saudis are not backing down from the oil price war for market share and are planning another increase in its oil exports starting in May. A prominent Saudi establishment commentator Bernard Haykel wrote recently that Riyadh’s decision reflects a broader and more fundamental strategic shift led by the Crown Prince. To quote Haykel, “He (Crown Prince) has embarked on a policy of capturing market share rather than trying to set the price.”

Indeed, the warning bells are ringing already for the shale industry. Tens of thousands of roughnecks are getting laid off. The Oil Price magazine forecasts that layoffs in the US oil industry could be as high as 200,000 jobs.

Tens of thousands are getting laid off in the US shale patch

Tens of thousands are getting laid off in the US shale patch

The Brookings Institution anticipates in a study that the Midland-Odessa region of West Texas, where Occidental Petroleum and Parsley Energy have dominated, could be decimated. A top oil executive, Dan Eberhart, CEO of Denver-based Canary has been quoted as saying, “There’s definitely blood in the water. The weakest oil and gas companies, oilfield service companies and banks with heavy energy exposure might submerge beneath the waves before the end of the cycle never to surface again.”

The ripple effect is staggering. When the fracking companies go bankrupt and cannot repay debts, the credit market and the banks face a crisis, which in turn threatens the whole system of oil stock exchange.

Simply put, Saudi Arabia and Russia have dealt a lethal blow to the decade-old American fracking industry, which they have seen as a mortal enemy. The crux of the matter is that they are independently fighting the US and are determined to take the price war forward to conclusively finish off the American encroachment into their market share. (See my blog Oil price war is more about market share)

Recently, the chairman of Russia’s state-owned Rosneft, Igor Sechin, who is a longstanding associate of President Vladimir Putin, stated bluntly that as soon as US shale leaves the market, prices will rebound and could reach $60 a barrel.

The bottom line is that for President Trump, the political costs are exceedingly high. For one thing, his boast that the US has become the most significant player in global oil markets is coming unstuck and his agenda to secure “energy dominance” on the back of a shale boom is exposed as a pipedream.

More importantly, Trump’s trademark policy of weaponisation of sanctions against Iran, Venezuela and Russian oil industry and its flagship Nord Stream 2 gas pipeline project to grab these countries’ market shares is running into headwinds.

Russia is moving in quickly to turn the “oil war” also into a war for natural gas market share in Europe. Russia has watched with unease the arrival of shale gas on European shores that could potentially erode its commanding position as the single largest supplier of natural gas to Europe. The US has been touting the LNG sales to Europe as “freedom gas”, which helps European countries to reduce their high level of dependence on Russian supplies.

The US sanctions against Nord Stream 2 gas pipeline project, which connects Russian fields with Germany and northern Europe and was nearing completion, is a case in point. The sanctions targets Russia’s Gazprom from expanding and consolidating its towering presence in Europe’s energy market. Unsurprisingly, Moscow is in an unforgiving mood.

Following Trump’s phone call to Putin, the White House said the Russian and US leaders “agreed on the importance of stability in global energy markets.” The US Department of Energy Spokeswoman Shaylyn Hynes hyped it up further and told TASS, “[US Energy] Secretary Brouillette will discuss with his Russian counterpart, Minister Novak, ways the world’s largest producers can address volatility in the global oil markets during this unprecedented period of turmoil.”

But the Kremlin readout merely said, “They (Trump and Putin) exchanged views on the current state of the global oil market and agreed that Russian and American energy ministers should hold consultations on this topic.”

The big question is whether Trump’s phone call to Putin signifies Washington’s first step in a historic move to cooperate with Moscow in energy market management. Objectively speaking, the oil crisis needs a joined-up international response, and, arguably, the solution lies in looking beyond OPEC (and OPEC+) at a wider coalition — OPEC++ that includes the US. In principle, Saudi Arabia and Russia would favour the idea that the high-cost producers outside the OPEC+ group must finally share the burden of balancing the oil market.

Given the fact that Trump is vying for re-election this year and a significant portion of his supporters are engaged in shale oil and gas production, he may bite the bullet — at least, as a one-off, time-limited bite.